America's Debt and What's Coming

Early in the 1950s, the average American typically made purchases with cash. If they wanted to buy Christmas presents, they used layaway plans. (Make the purchase in a store, make a down payment, and then make payments until paid for — in time for Christmas — hopefully.) If they needed to buy a car, they often saved up until they had the cash to pay for it.

Early in the 1950s, the average American typically made purchases with cash. If they wanted to buy Christmas presents, they used layaway plans. (Make the purchase in a store, make a down payment, and then make payments until paid for — in time for Christmas — hopefully.) If they needed to buy a car, they often saved up until they had the cash to pay for it.

Then in the 1960s, along came the credit card. Ah, now you can have what you want now and pay for it later. But that wasn’t such a bad deal since interest on a credit card was typically only 6%. (Which everyone thought was outrageous.)

Homes on the other hand, due to their high cost, were items that almost everyone had to buy on time. A 20-year home loan normally had a 6-8% interest rate. But in the late 70’s those rates went through the roof! Interest rates went as high as 18%! It was a time when buying a home was almost out of the realm of reality for most people.

But, we found a way to get around the situation – we started getting 30-year loans. This helped the buyer by extending the debt ten more years which made for smaller house payments – but higher total interest paid on a house. By the 90’s the rates were back down again. But, the public kept buying homes with a 30-year loan to keep their house payments even lower. Which means their debt (principle) dropped ever so slightly every year over a very long time, thus increasing interest paid. It typically took a career to pay off a house. But to the plus side for those deficient in money management, it meant they could buy those jet skis, ski boat, new car, etc. with the money saved with their re-fi and lower interest rate.

Now today, homes are much more expensive and have lower home loan rates, but the average person is drowning in debt. Now they buy a home for not $30-50K, but $300-600K+. When you calculate the interest on a home with that high a cost, it is really non-trivial. Whereas the percentage of income to home-loan ratio used to be 20-30%, today it is often over 50%! That is a significant burden on a household.

But consumer debt building doesn’t stop there. We pay for a lot of things on time. Although they may only be pennies each month, they add up. We hear commercials like, “Buy this for only 75 cents per day.” “Buy that for merely $1.50 per month.” “Give to this charity for only $15 per month and we’ll send you a ‘free’ blanket.”

Where’s all this money coming from?

Car payments are getting crazy due to the total cost of a vehicle including the ridiculous initial cost. In the 50’s cars cost around $2-3K new. Today we see blue-collar workers buying trucks for over $70K – on time!!

About now you’re asking, “What’s your point?”

The point is that consumer personal debt is now over $32T – greater than the national debt!! Remember the 2008 real estate bubble crisis? Well, we’re waaayyy past that by a long shot now.

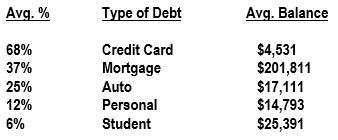

73% of Americans Die With a Debt – $62,000 on Average

Here’s a list of the debt item categories for the average American today when they ‘check out’.

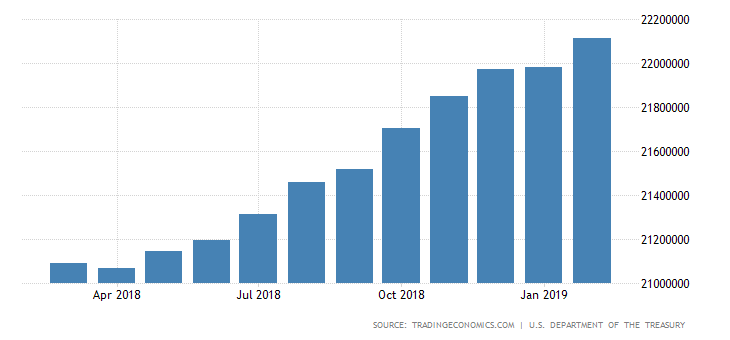

In recent years the feds under the great Obama’s watch chose to assume all college tuition loans. That loan amount exceeds $1T today. Here’s a chart of that buildup.

If the feds forgive these loans as they have suggested they would do, who’s really going to pay off those loans?

For the most part, your debt dies with you, but that doesn’t mean it won’t affect the people you leave behind. If someone has enough assets to cover their debts when they die, the creditors get paid and beneficiaries receive whatever remains.

So what happens to the debt that you leave behind that isn’t covered by your assets at death? Answer: Someone has to pay it back. That ‘someone’ is either your family members, a financial institution, or the government. So now you should be asking, who pays back the debt holders and the government when you leave this vacuum of money behind? And the answer is, you the American citizen will have to pay back in one way or another that debt. Financial institutions raise interest rates and fees. The government raises your taxes.

Just like the $22T federal debt we have currently (and growing), debt eventually comes due – one way or another. The way you pay them back depends on the economy and what’s happening at the time of the ‘crash’. Today if you took the federal debt and divided it up, it would amount to $860K per family in America. Because the average person in retirement today has less than $60K in savings, I don’t think we can clean out everyone’s bank account and fix the problem.

Unlike the federal government, you cannot continue to mount debt on debt forever. No matter how ‘slow’ someone may be, eventually they catch on that they’re in trouble. When that light bulb comes on, the average person finally does what they should have years earlier – stop bleeding money.

When enough people stop spending money, the country starts losing sales and income. Why? Because 70% of our GDP is American consumers buying products. That is the predominant engine driving our economy. When that falters, so does the economy in general. Worse, it leads to other countries faltering with us, which further leads to a global recession, which in turn leads to worse problems.

This is what I call the rubber-band affect. You can stretch a rubber-band only so much and then is snaps — and often hurts when it does. It doesn’t fall apart slowly, it just gives way all at once (comparatively). THAT is where we’re headed.

So now the question is, when this economic tsunami hits, what will rid us of this debt?

My guess is, we will pay it back with sweat or blood. Sweat if the dollar crashes (which is projected) by lowering wages (i.e., sweat), or blood via war. Like WWI & II, the U.S. economy was driven by industrialization making war machines and supplies. But imagine working 12 hour days for $10 per hour. Given the rumors of war today with Russia and China (at least), this isn’t out of the realm of reason.

At this point the question may raise in your mind, “So what am I to do?” The answer is prepare. The way you prepare is to get out of debt – quickly. The less debt you have and the more cash (recession proof assets) you have, the better off you’ll be in the long run. This is a serous matter and can be a life or death situation depending on your location and financial status. This isn’t an action to take a few years from now, but today! Don’t wait, it may be too late.

If you don’t know how to save money or get out of debt, check out Dave Ramsey’s website for ideas. He has a radio show daily where he discusses the average person’s debts and how to rid yourself of them. At the very least, stop the hemorrhaging of your wallet now. You don’t want to dig the hole any deeper at least.